The partnership priorities for investors and start-ups

Over the past decade alone, there has been a seismic shift in the number of digital start-ups entering markets across the UK, often with a view to driving innovation and disrupting the status quo for the greater good of their industries, the economy and wider society. The Tech Nation 2017 report found that digital tech investment in the UK during 2016 reached £6.8 billion in venture capital and private equity investment, 50 per cent more than any other European country. Furthermore, the turnover of digital tech businesses reached £170 billion, an increase of £30 billion in just five years and a clear indication that the UK remains at the forefront of business innovation.

The acceleration and rapid growth of technology-driven enterprises has sparked interest from a range of investor groups, who clearly see the potential in the sector despite the Brexit blues and ongoing negotiations about Britain’s position following the divorce from the EU. Whilst this appetite for investment is positive for founders who may be considering financial support to turn their ideas into reality, it has thrown in to the spotlight, the need to understand the priorities of both parties when it comes to identifying an investment opportunity and a suitable delivery partner.

Jessie J professed that it’s ‘all about the money, money, money’; and yes, that’s useful when considering funding options, be it from the likes of accelerators, angel investors, crowdfunding or large VC’s. Often less considered by entrepreneurs and start-ups is the wider support requirement beyond funding, and how influential this can be when it comes to realising their growth ambitions.

With you for the adVENTURE

This is lesson one; do your homework. Figure out what you need and then establish where you’re most likely to get it. That said, of equal importance is for the investor community to understand themselves what the priorities are for start-up businesses so that they can create a genuine support proposition which extends beyond just finance.

The UK Innovation Hub recently carried out some research with Tech City, to find out exactly what start-ups want and need from potential investors. Over 160 UK tech founders and aspiring entrepreneurs were interviewed to help provide an understanding of their biggest barriers to success, and the role of the investor community in helping to overcome these.

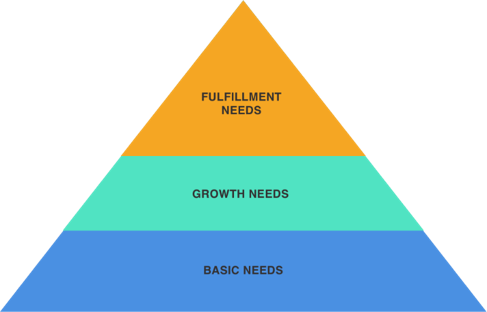

Maslow’s (1943, 1954) hierarchy of needs is a motivational theory comprising a five tier model of human needs. Its central tenet is that people are motivated to achieve certain needs and that some needs take precedence over others. Unsurprisingly, our most basic need is for physical survival, and this will be the first thing that motivates our behaviour. Once that level is fulfilled the next level up is what motivates us, and so on.

This is a useful framework to illustrate the findings of our research, and understand what entrepreneurs really need from their investors and vice versa.

The path to fulfilment

At the bottom of the pyramid are the ‘basic’ needs. For start-ups, our research revealed the most fundamental need is of course access to finance. Beyond this, the priority hygiene factor is the ease of onboarding. Other basic needs – such as free office space and professional services or pitch training – are relatively inconsequential; only a minority of start-ups deem them to be important to their choice of investor.

Once an investor proves they can provide the ‘basic’ needs, they then need to be able to demonstrate support for the ‘growth’ needs. Most of the founders we interviewed stated that access to expertise, contacts and a wider network of investors was invaluable.

At the top of the hierarchy of needs is ‘fulfilment’. Personal chemistry emerges as perhaps the most critical factor with more than nine in ten start-ups looking for an investor they genuinely like and trust. A similar proportion stated that it is important for investors to be in tune with their vision and two thirds of start-ups also welcome the reassurance that their investor had a strong track record.

Part of our research also involved examining the growth hurdles facing UK digital tech businesses, which again revealed access to capital as the salient stopping point, with marketing and customer acquisition emerging a close second. Finding the right talent remains a priority and a key challenge for many early stage start-ups who cite programming skills as being in high demand. Beyond this, it’s the desire for developers and designers that is keeping founders awake at night, with support and administration unsurprisingly, less of a headache.

The benefits of belief

So, what conclusions can we draw from this research? Surprisingly, the main criterion for founders is that investors trust them and understand their vision.

With a huge network of investors developing alongside the UK’s digital start-ups, it’s encouraging the see that personal belief, reassurance and trust remains at the heart of the investor/entrepreneur relationship.