Electric vehicles could unlock tax benefits for thousands of UK SMEs

Businesses may be able to claim tax relief while boosting their green credentials by embracing electric vehicles (EVs).

Advisory and accounting firm, Haines Watts has encouraged business leaders to explore the potential tax benefits, both on a personal and corporate level, offered by switching to greener vehicles.

Propelled by the global shift towards sustainability, the UK Government has pledged that all cars and vans will be zero emissions by 2035 – a move which has been bolstered by the Prime Minister’s announcement that new homes, as well as buildings such as supermarkets and workplaces, will be required to install electric vehicle charge points from this year.

In the wake of COP26, UK businesses across a wide range of sectors are rethinking their sustainability strategies, supported by initiatives such as the Small Business Energy Efficiency Scheme (SBEES)outlined in the Government’s Net Zero Strategy.

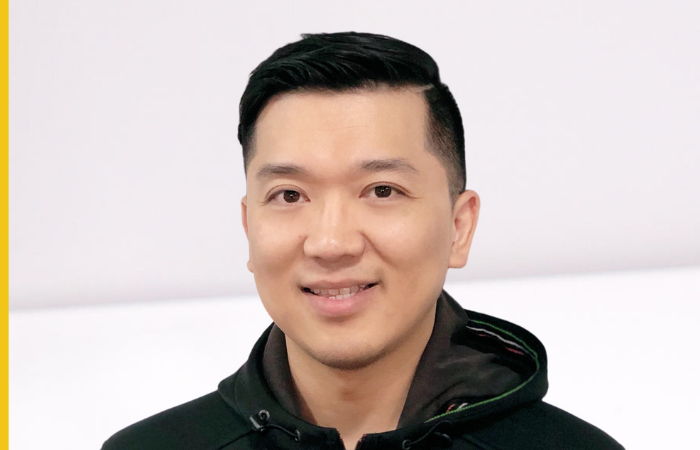

Adopting low emission vehicles can help businesses meet their sustainability targets while also taking advantage of government incentives. Abid Khan, Associate Partner at Haines Watts, Hornchurch, said: “Choosing an EV is a more environmentally conscious option, making your car usage more sustainable, helping to meet the UK’s 2035 target while also offering potential tax relief.”

Indeed, electric vehicles (EVs) are becoming a far more common sight on British roads. According to ONS data, 44% of the British public think it is likely that they will switch to an all-electric vehicle in the next decade. In terms of consumer preference, the Government’s strategy of making EV the dominant form of transport seems to be gaining traction.

But what are the benefits for businesses and directors when it comes to switching to greener transport such as EVs. As well as helping to meet ever-increasing environmental, social and governance (ESG) objectives, electric vehicles may also provide firms with a tax-efficient alternative to traditional petrol and diesel cars.

Abid explained: “EVs are now a very attractive option for any business owner, director or senior executive that’s looking to upgrade to a new company vehicle. They have a very low benefit in kind (BiK) rate as the tax rate is currently set at 1% for the 2021/22 tax year, making it a highly tax-efficient option for individuals. The Government is also currently offering a ‘plug in grant’ of up to £2,500 for qualifying EVs that meet the relevant eligibility criteria.”

The fact that the plug-in grant covers a range of vehicles, including cars, motorcycles, small and large vans, means that SMEs at varying stages of growth can access EV financial support suitable for their circumstances and business needs.

Some employees may be averse to the idea of an electric company vehicle, because they benefit from claiming mileage expenses. However, Abid confirmed that employees and business owners can still claim their business mileage when using electric vehicles: “Even though you’re not using petrol, you can still claim the government-approved mileage allowance for an EV. The rate per mile will vary where the car is owned by the company or by an employee.”

EVs can be bought outright as a longer-term investment for the company, allowing businesses to claim capital allowances against the expenditure as an asset. Alternatively, EVs can be leased, although capital allowances can not be claimed for these.

As Net Zero approaches and targets become more stringent, there may be the opportunity for SMEs to take advantage of incentives for adopting green energy solutions. EVs offer a way for businesses to stay ahead of the curve in terms of sustainability while also taking advantage of tax and financial incentives.